Category

Perspectives

5 truths and myths about the state of U.S. housing

Posted by AMH Team

10m read time

Mar 28, 2024

Across the media spectrum, news outlets report that Americans are down on a strong economy and public opinion is disconnected from traditional markers of financial health.

Part of this low sentiment is due to perceptions about the state of housing.

In a public opinion poll from the Opportunity Starts at Home campaign, commissioned through Hart Research Associates:

85% of respondents (95% of Democrats, 87% of Independents, and 73% of Republicans) said they believe that ensuring everyone has a safe and affordable place to live should get national attention

89% said it’s a “big problem” when households spend more than half of their income on housing costs

61% said they have made at least one sacrifice—such as taking an additional job, cutting back on healthy food or health care, and skipping bills—in the past three years to pay for housing

In this month’s newsletter, we explore five truths and myths about the state of U.S. housing to understand what’s fact, what’s feeling, and what’s behind it all.

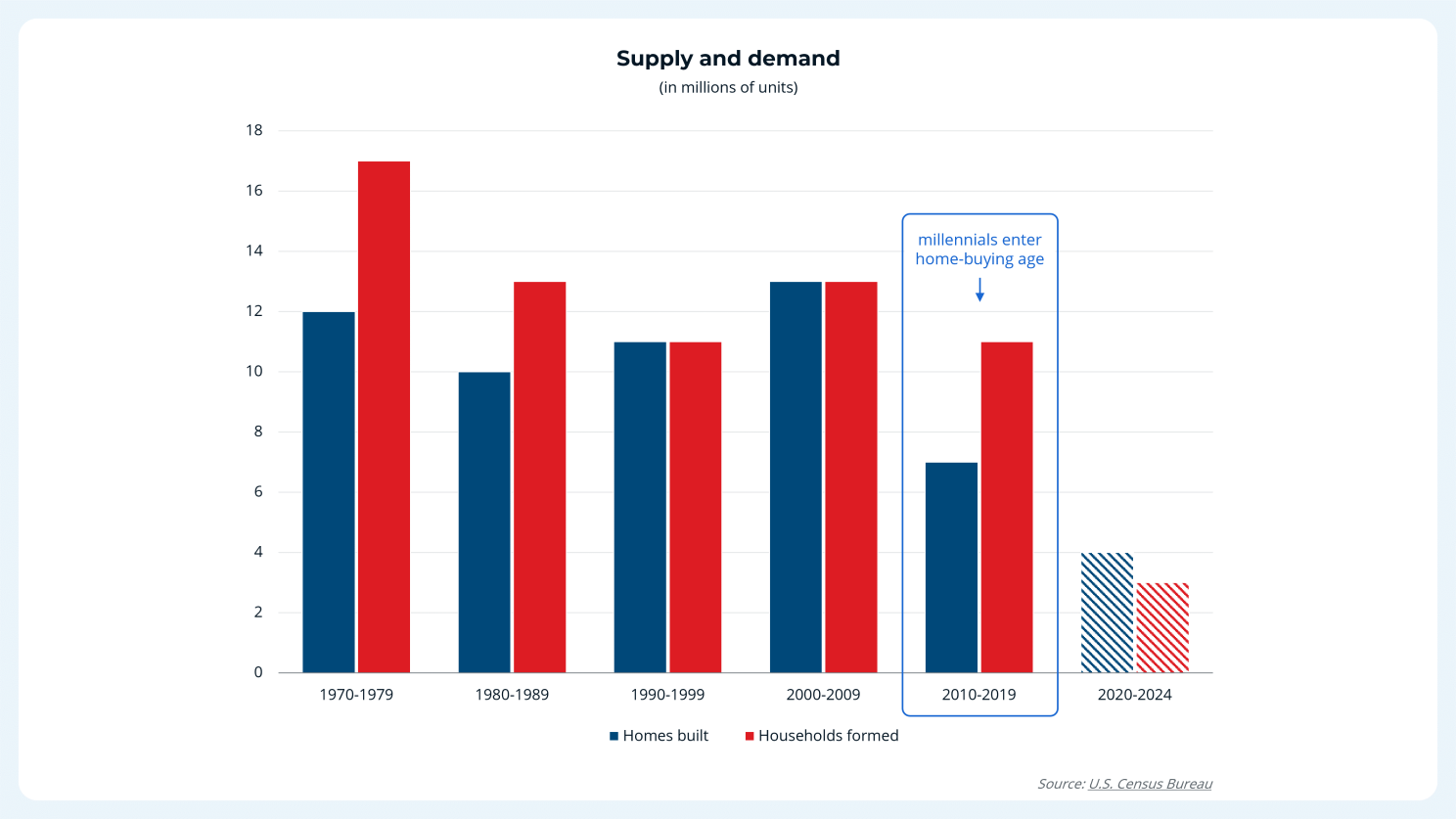

Truth: The U.S. hasn’t been building enough new homes to keep up with demand.

Following the 2008 recession, which burst an inflated housing bubble, the country experienced a decade of pronounced underbuilding.

In the lost decade of the 2010s, housing production plummeted by nearly 50%, contributing to an inventory shortage that is currently estimated in the millions.

Housing experts point to driving factors that include: a chronic lack of skilled workers, a shortage of buildable lots, increasingly onerous regulations, high tariffs on lumber and other key construction materials, and slow growth in acquisition, development, and construction lending.

But as millennials entered home-buying age, household formation continued to grow.

Then, in 2020, the COVID-19 pandemic and remote work boom seeded even more demand for single-family homes, widening the supply-demand imbalance.

Why does that matter?

“As we all learned in Economics 101, strong demand coupled with low supply means higher prices,” David Howard, Chief Executive Officer of the National Rental Home Council (NRHC), recently told REI INK.

And this applies across housing types, both owner-occupied and renter-occupied — an approximately 65%-35% distribution that has remained largely the same since the 1960s to today.

“It is important to begin with the basic fact that high home prices and rents are the result of the housing supply shortage, caused by more robust household formation relative to increases in the housing stock,” reports the Urban Institute in a recent research study.

Truth: It’s the least affordable housing market in recent memory

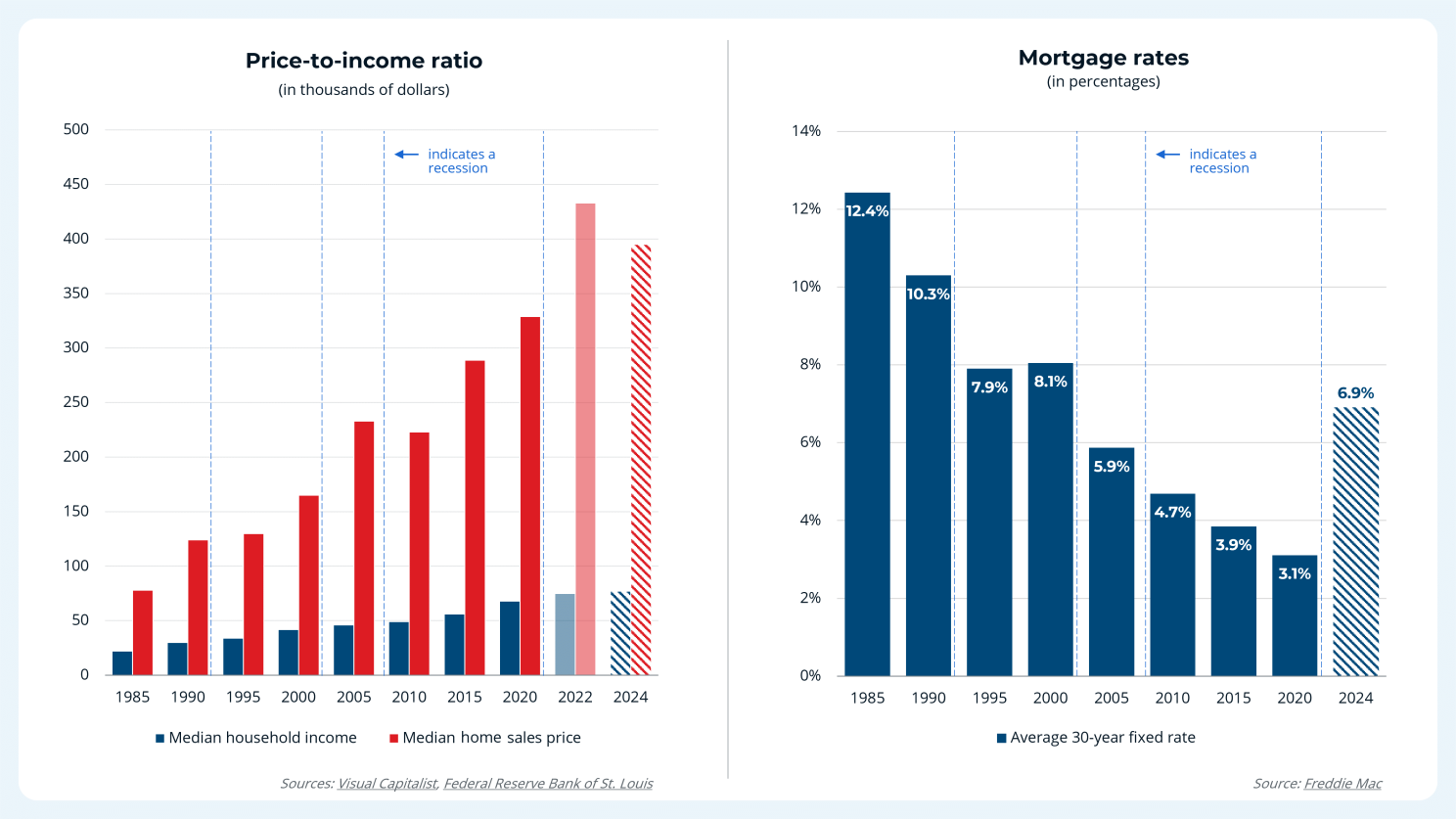

Driven by critically low supply, house prices have steadily surged in the last four decades.

But wages have failed to keep pace, challenging affordability further.

When the Federal Reserve began tracking this data in the mid-1980s, the house sales price-to-income ratio stood at approximately 3.5.

Although high mortgage rates at the time meant a significant portion of household income went to interest payments, it was the most affordable houses have been in the U.S. since.

Lowering mortgage rates over the years have periodically cushioned the impact of swelling prices. But the recent uptick in interest rates has put the imbalance into evidence more than ever.

Today, median house prices are nearly 6x the median household income in America, higher than at any point on record dating back to the early 1970s, according to the Joint Center for Housing Studies of Harvard University.

“The income needed to comfortably afford a home is up 80% since 2020, while median income has risen 23% in that time,” reports Zillow.

“As home prices and interest rates rise, would-be homebuyers need a salary of $114,627 to afford a median-priced house in the U.S.,” adds CNBC, citing Redfin data. “If you want to buy in one of the most expensive metro areas of the U.S., you’ll need to earn even more. In the top 10 cities, you’ll need to earn more than $200,000, or close to it, researchers estimate. Buying in the priciest two metros would require salaries of more than $400,000.

Myth: Someone is to blame.

A healthy housing landscape depends on a delicate equilibrium of four primary dynamics:

- Supply – number of homes.

- Demand – number of households.

- Pricing – affordability of homes.

- Income – access to housing.

As we’ve seen, today, that equilibrium is off-balance. Low supply and high demand have driven price increases that are rising faster than income growth.

But this nuanced equation means there is no single party responsible:

It’s not the Federal Reserve.

Government programs to marginally expand mortgage availability may periodically impact prices. “But overall housing demand is the same whether a household owns a home or rents one from a landlord. A modest change in mortgage eligibility standards or mortgage pricing does not create new demand for houses. Instead, it simply makes it possible for some renter households to get a mortgage and for some of the newly eligible households to choose owning instead of renting. It does not make sense that a mortgage price cut would considerably increase the number of households, especially as most households start off as renters.” (Urban Institute)

It's not the Boomers.

Understandably, homeowners with historically low mortgage rates don’t want to sell. Nearly 40% of Americans born between 1946 and 1964 have lived in the home they currently own for at least 20 years. These older Americans are aging in place for the financial incentives, either with no outstanding mortgage or a much lower rate than they would if they sold and bought a new home with today's rates, which are hovering around 7%. "Previously, older generations would move into smaller homes once they retired, which freed up inventory for younger families and first-time buyers. Lack of homes for sale and high housing costs contributes to people staying in their homes longer, and people staying in their homes longer contributes to lack of inventory and pushes prices higher." But this is an effect, not a cause, of undersupply. (Bloomberg, Fox)

It’s not Wall Street.

Institutional investors, which are estimated to own around 3 percent of the single‐family rental stock, don’t have the type of pricing power to push up rents and home prices. “They are not why rents are so high or why homeownership is out of reach for so many. Investors are not driving the unaffordability; they are responding to it. The other deceptive part of the latest scapegoat story is that these institutional investors are regularly outbidding homebuyers with all-cash offers. Although all-cash offers are certainly on the rise, many of these bids are from wealthy people, house flippers, or smaller landlords. Many different investors are all flocking into the housing market; what is most relevant is the fundamental reason they are all being drawn there. Housing is primarily unaffordable in this country because of persistent undersupply.” (The Atlantic, The Washington Post)

It's not developers.

Some believe builders focused on high-end developments are driving up prices, too. “A more accurate framing would be to say that supply is supply, regardless of the price point, so the more we build, the better. More affordable homes reach the segments in need faster, so policymakers should try to make housing affordable where possible, but more housing is always better than less housing. Building more homes (including high-end homes) increases the overall housing supply. This is connected to the notion of filtering; as new higher-priced homes enter the market, some households move up, leaving vacant older properties, which causes prices and rents on these properties to fall.” (Urban Institute)

The truth?

The #1 villain in this story is undersupply, relative to growing demand.

Myth: The problem is too big to solve.

Current estimates around the housing shortfall range from 3 million to over 7 million.

According to The New York Times, “the country is short anywhere from 1.5 million to 6.5 million new homes, depending on whom you ask, because developers have not built nearly enough housing since the foreclosure crisis to keep up with a growing population.”

Whatever the precise number, if the challenge is mass undersupply, it stands to reason that we need to build.

Housing experts increasingly agree that “the federal government must specify a housing supply policy that prioritizes the most cost-effective ways of increasing supply,” both incentivizing the development of new units and providing subsidies to support affordability.

In the meantime, the market is getting creative.

More and more states are looking to zoning reform to expand their housing stock and tackle affordability challenges.

Bloomberg reported 2023 pro-housing victories across bipartisan lines in Arkansas, California, Florida, Maine, Montana, New Jersey, North Carolina, Ohio, Oregon, Washington, Wisconsin, and more, with the passage of hundreds of bills that promote construction to “end a national housing crisis that is many years in the making.” NPR reports that, while zoning reform looks different in every region, many city leaders are advocating for the same principles: "gentle density," building "missing middle" housing, and creating more choices.

Young home shoppers are partnering with friends and family, “hacking” their way to ownership.

“For a household making the median income, it would take almost 8.5 years before they would have enough saved to put 10% down on a typical U.S. home, about a year longer than it would have in 2020. It’s no wonder, then, that half of first-time buyers say at least part of their down payment came from a gift or loan from family or friends.” (Zillow)

“A lot of folks can't really afford to get into a house, so one of the things that they're doing - what we call a House Hack - is, they have to qualify for this home on their own, but as a way to make this more affordable is they're bringing on roommates or renting out rooms and things like that to kind of make the monthly nut seem more manageable and not be married to the house and the mortgage.” (WJAR)

In the rental sector, professional operators are doing their part to rebalance the scales.

Companies like AMH are building new homes at a rapid and consistent pace, adding much-needed supply to the national rental stock and quality options for “workforce housing” and “missing middle” households in search of single-family living.

As they build, AMH and others are also selling off previously acquired houses back to regular homebuyers through the MLS, often after having invested significant capital into rehabilitating them (Insider).

A study by the New York University found that “the increase in the supply of rental housing allowed the financially constrained to move into neighborhoods that previously had few rental units,” supporting greater access to quality housing and upward mobility for middle- and lower-income households (NRHC).

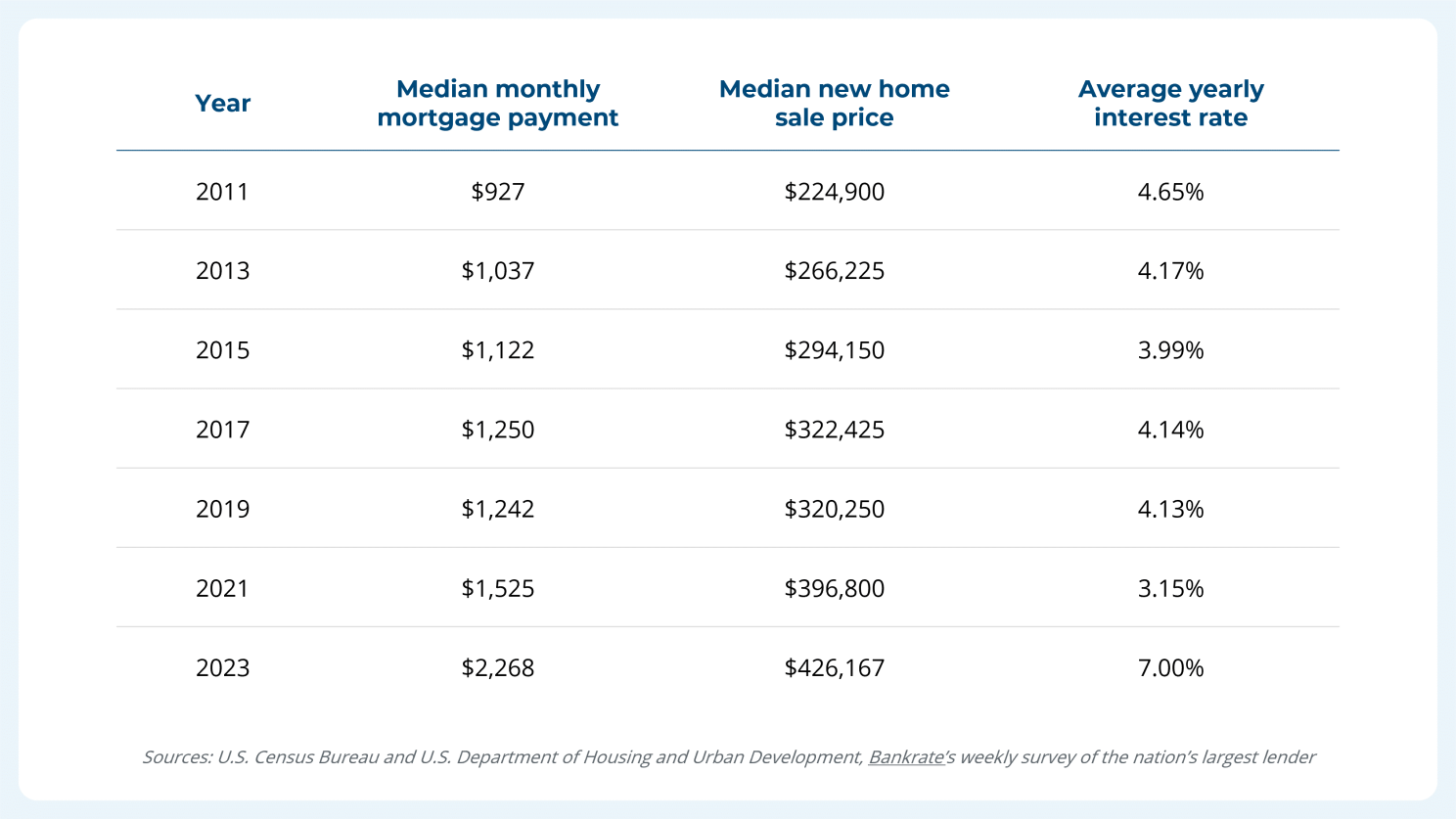

Myth: Buying is always better than renting.

While undersupply is challenging affordability across housing types, sales prices have outpaced rental prices by more than 40%.

Historically, purchasing a home has made financial sense for people who expect to stay put long enough — commonly, 5 to 10 years — to shave off their mortgage, build equity, and reap the rewards of rising market value.

“That equation might still work. Yet, housing prices have climbed so high that many potential buyers can't afford the investment,” reports USA Today. “The spiraling costs of homeownership have turned the perennial rent-versus-own equation on its head. In most of the nation’s largest cities, renting is now far cheaper.”

And it’s not just the price of the house.

Assuming the annual average rate for a 30-year fixed-rate mortgage with a 20% down payment (Bankrate):

There’s also property taxes, interest, insurance, maintenance, and homeowners association costs, not to mention your credit score and what mortgages you’re qualified for to begin with.

Add that to credit card debt skyrocketing, rainy day funds plummeting, and childcare costs rising, and the difference in monthly expenses can make or break a typical household budget.

In 2024, “renting can be the smarter financial choice in many markets,” says Susan M. Wachter, a professor of real estate and finance at The Wharton School of the University of Pennsylvania” (CNBC).

Beyond simple arithmetic, American households today are also prioritizing other lifestyle factors in their housing choices, like a sense of community, geographical and financial flexibility, the convenience of amenities and services, and access to select neighborhoods and school districts.

In The New American Dream report, Entrata found that “more people are renting by choice and not because they can't afford to own a home. In fact, 1 in 5 (20%) expect to be lifelong renters, an increase of 33% percent from 2021 (15%).”

Some of these households are questioning the long-held assumption that homeownership is the safest way to build equity, especially in this atypical economic landscape.

“Not only do you run the risk of decreasing property values, but there is also the risk of large unforeseen maintenance or repair expenses,” reports Forbes. “While it’s true that homeownership can help you to build wealth over a long period of time, there are other types of investments that may give you a better return.”

Until the U.S. has addressed its underlying supply problem, more and more households — whether they rent or own — are choosing to chart new paths to the American Dream.

Learn how AMH is contributing solutions to the national housing undersupply challenge by building thousands of homes every year:

© 2025 American Homes 4 Rent, LP

All graphics, images, drawings, plans, photos, details, and videos, along with all artistic concepts and depictions in digital renderings and virtual tours and stagings, are for illustration purposes only. The actual appearance and features of the properties and communities may vary. Please verify all community and property details prior to signing a lease. American Homes 4 Rent®, AMH®, AH4R®, Let Yourself In®, AMH Development®, American Residential®, and 4Residents® are registered trademarks of American Homes 4 Rent, LP. 4Rent℠, AMH Living℠, and 4Communities℠ are service marks of American Homes 4 Rent, LP. AMH refers to one or more of American Homes 4 Rent, American Homes 4 Rent, L.P., and their subsidiaries and joint ventures. In certain states, we operate under AMH, AMH Living, or American Homes 4 Rent. Please see www.amh.com/dba to learn more.